10 of the cost up to 500 requirements typical bulk insulation products can qualify such as batts rolls blow in fibers rigid boards expanding spray and pour in.

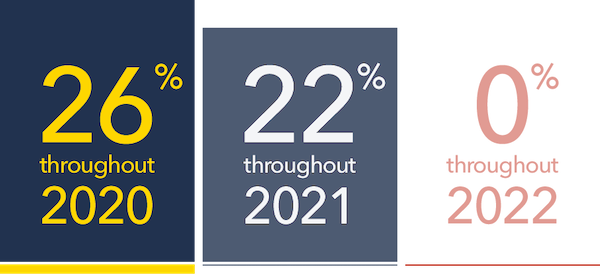

Indiana insulation tax credit 2016.

The credit for home insulation exterior doors certain roofing materials and exterior windows and skylights was just 10 of the cost.

This credit expires 12 31 2016.

Under current law dec.

Energy efficient home improvements may qualify for a tax credit and the maximum tax credit for all improvements made is 500.

This tax credit is 30 percent of the cost of alternative energy equipment installed on or in a home.

Homeowners interested in claiming the tax credit need to have their systems installed before december 31 in order to claim the credit in their 2016 taxes.

Residential energy efficient property credit.

The credit was only available through the 2016 tax year and is not available for 2017.

Based on the credits shown on their website there is no longer an energy credit for indiana state income tax.

This includes the cost of installation.

The tax credits available for new geothermal units are expiring at the end of this year.

The consolidated appropriations act 2018 extended the credit through december 2017.

31 2016 was the deadline for qualifying improvements to the taxpayer s main u.

Water heaters furnaces boilers heat pumps air conditioners building insulation windows and roofs.

You could deduct 100 of energy related property costs but this.

This wasn t a particularly generous tax credit.

Residential renewable energy tax credit a federal level investment tax credit itc is now available to consumers wanting to purchase small wind turbines solar panels or geothermal heat pumps.

Eligible technology includes the following.

The itc written into law through the emergency economic stabilization act of 2008 is available for equipment installed from oct.

Unfortunately the tax credit of 10 of the cost up to 500 00 expired december 31 2016 for home insulation products including batts rolls blow in fibers rigid boards expanding spray and pour in place insulation.

3 2008 through dec.

Residential energy efficiency tax credit.

Insulation this tax credit has expired adding adequate insulation is one of the most cost effective home improvements that you can do.

30 for property placed in service after december 31 2016 and before january 1 2020.